Reimagining Finance for a Regenerative Future

Inspired by the 1944 Bretton Woods Conference—which established influential global institutions like the World Bank and the IMF after WWII—we partnered with Middlebury College to cultivate their vision for a new type of gathering at their Bread Loaf Campus in Vermont's Green Mountains. Here, speakers and participants, professors and students, and experts and non-experts stood on equal footing. Our goal was to examine the global financial system from a Global North/South and intergenerational perspective, addressing today’s multitude of crises, otherwise known as the polycrisis. Combining Middleburys' subject matter expertise and influence, and See Change's operating and design systems, we kicked off the project by working closely with a select group of students to co-create the agenda and experiences that would matter most to them.

In the tranquil setting of the Bread Loaf Campus in Ripton, VT, we aimed to empower the next generation of leaders to reshape the financial architecture and develop sustainable solutions for essential common goods like clean air, soil, and water. By purposefully designing a series of physical and sensory experiences, hands-on labs, and meaningful opportunities for connection, we bridged distinct perspectives and shattered the “stuffy conference” model in favor of a more holistic and generative experience. Creating environments that empower students to build confidence, think creatively, and innovate while collaborating with leading experts.

“It helped me reconnect and disconnect. It was a space where we had to discuss things not popularly featured in mainstream learning spaces.” –Aja J., Student

We delved into the integration of systems-thinking into our financial philosophy. We revisited the institutions set up by the original Bretton Woods agreement with fresh eyes to tackle new challenges faced by emerging economies and developing countries when it comes to climate change. We stepped into the realm of creativity in an immersive workshop that blended music, conversation, and collaborative exploration that pushed everyone out of their comfort zones. Between shared meals and storytelling, breath-based flows, cold plunges, and fast-paced discussions on demystified topics, we explored the relationship between humanity and the natural world. All in an effort to recalibrate the global financial system with a focus on equitable economies and climate sustainability.

“The intellectually stimulating discussions were complemented by immersive experiences like Nordic breathing exercises, cold plunges, yoga nidra, and glass-making, which not only broke the mold of conventional conferences but also fostered deep connections among participants.” –Shehryar Q., Graduate Student

We gathered some of the most influential voices in climate and finance. We welcomed Peter Senge, renowned systems thinker from MIT, and Mia Mottley, Prime Minister of Barbados and founder and visionary leader of the Bridgetown Initiative. Pep Bardouille, Climate Advisor to the Barbados PM, shared her vision for Bridgetown 3.0. Fadhel Kaboub, advisor to the Independent Group of 77, shared insights on executing a Just Transition. Tyler Christie, a pivotal voice in climate technology VC discussed mitigation and adaptation investment strategies. Leading environmentalist and author Bill McKibben highlighted the urgency of climate action, and Ralph Chami, former senior executive at the IMF, spoke on the nature-based economy. This exceptional lineup made our event a convergence of groundbreaking ideas for a sustainable future.

CONTENT TRACKS

A Path to Ecocentric Financial Reform

Changing the mindset and behaviors of individuals and the private sector from extractive to regenerative involves the recognition of the value of living nature and ecosystem functions. In particular, the pricing of the ecosystem services of a living nature, where possible, must be market based so that global markets can recognize the value of this new asset class.

Integrating Polycrisis into Central Bank Monetary Policies

In the face of the cascading and connected crises related to climate change, global conflict, and inequity, it is not an exaggeration to say we are in the midst of a polycrisis. Central banks can play a crucial stabilizing role in the global financial system or further exacerbate these challenges. Participants urged central banks to enhance their roles significantly in addressing global challenges.

Tackling Challenges in Global Food and Water Access

The global food system is intertwined with climate change, biodiversity, migration, and patterns of conflict, so it is imperative that future actions avoid exacerbating negative feedback loops. These natural assets are crucial for the transformation of the food system and for safeguarding water and biodiversity.

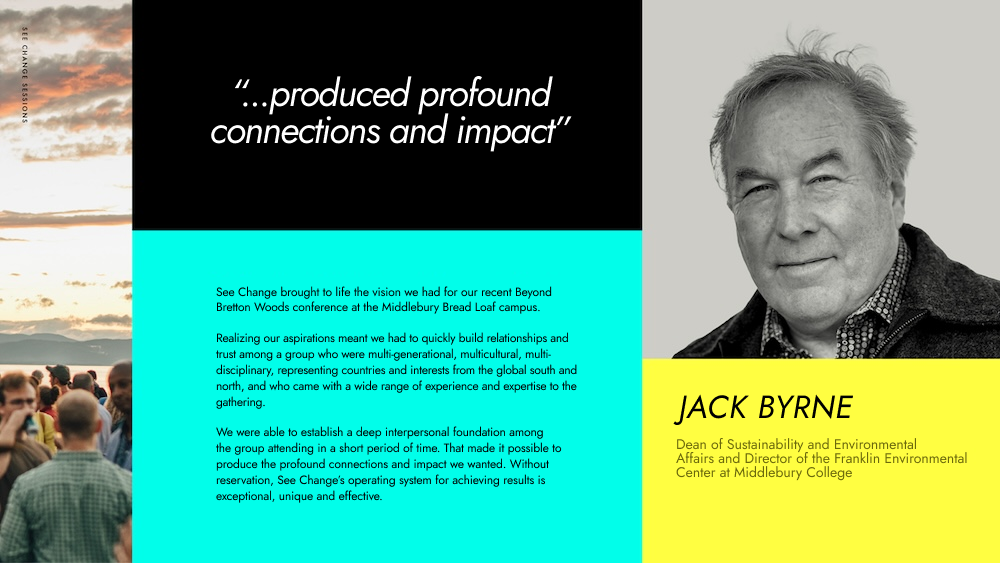

WHAT PEOPLE ARE SAYING

“This was a brilliantly designed event that embodied the spirit of intergenerational justice and balance across diverse perspectives. I appreciate how much was offered to next generation leaders and how much was received too.” – Stephen Posner, (Director of Pathways to Planetary Health, Garrison Institute)

“I have been on the content committee for Beyond Bretton Woods since September 2023…I've been a big part of the process of figuring out the topics that are most urgent for us to talk about. And this has been one of the most amazing experiences for me to see a lot of that work that I've put in coming out in these conversations between students and experts and everyone in the middle.” —Amaan H. (Student)

“I could not have asked for a better way to end my undergraduate journey at Middlebury! Thank you for bringing together leading minds across various careers, industries, and levels of education and experience! I'm excited to put the ideas into action!” —Mariia D. (Student)

“This was an incredible experience, and I'm thankful that many students (from Middlebury and elsewhere) could participate. A perspective-changing event!” —Dylan T. (Student)

“Having been deeply involved in planning and organizing it, I've gone from apprehension about what the three days would be like and what they bring to delight with the outcome. That's been a fantastic experience.” —Jack B. (Expert)